I’ll begin this article using a quote from warren Buffet: One of the most successful investors in the world and has a net worth of over US$85.6 billion as at 2020.

“Risk comes from not knowing what you are doing.”

Background:

Let’s be informed and then we won’t be in risk. Let’s dig into the topic. Before the beginning the story of “GameStop”, let’s pave the way, stocks or shares of a company, represent ownership equity in the particular firm. Stock markets are where investors come together to buy and sell shares. Well, it is basically a marketplace. Share price of an entity are set by “supply and demand” in the market as buyers and sellers place orders. Ok now, in a stock market, investors hope to sell a stock at a higher price than the price at which you purchased it to achieve a gain i.e, a capital gain. For your info, a dividend is the share of profit that a company distributes among its equity holders. Those are the two types of gains typically an investor get.

Short Sellers:

There is a bunch of investors called “short-sellers”, who do actually the opposite. Those type of investors borrows a stock from market through a lender for higher price, then sells stock back to the market. Short sellers are betting that the stock price will drop in price. Please follow this link to get an understanding what short selling is. Some news happens that creates optimism in a particular stock. It is obvious that, shares rise in response to a good news, which is basic in economics, where the demand goes up it’s price goes up. As a result “short-sellers” suffer losses which could lead to a margin call, in which broker force investor with short positions to either deposit money or close out their positions. Then, what happen is they actually they buy the stocks they borrowed at a higher price or keep pumping money. People normally buys the stock at the current price without loosing more. For stocks with massive amounts of short-selling, creates a snowball effect, leading to tremendous volatility and huge spikes in the share price.

What went wrong with Gamestop?

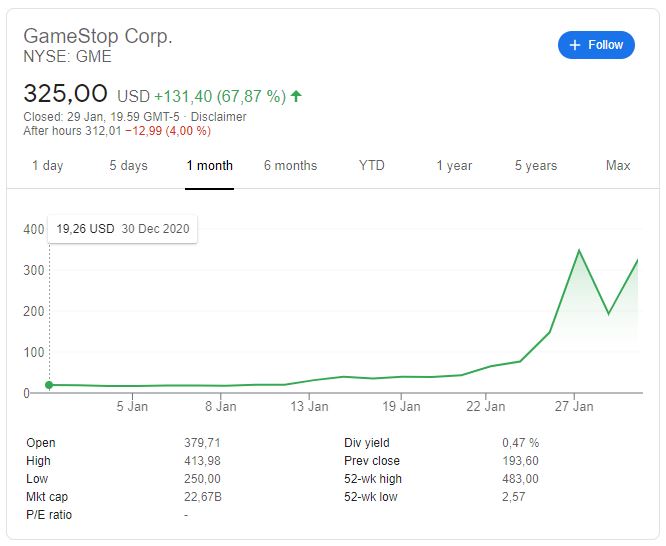

Alright, there is a video game retailer called “GameStop”, which is listed in NYSE with ticker name GME. If you don’t know what’s going there have a look at below quote from google finance (30th Jan 2021):

This is the reason for the pull back after reaching US$400+/share.

This is the story of GME and the take home message is when you invest, be aware of what you are doing. I mean the mechanism.

"Don’t loose your hard earn money."

*Please note that this article is not a financial advice.